Treasury proposes stricter measures for tax defaulters, relief for compliant taxpayers

One of the key proposals is to expand the scope of agency notices to include non-resident persons, allowing the commissioner to recover unpaid taxes from them more effectively.

The government has proposed a series of changes to the Tax Procedures Act aimed at improving tax collection, easing enforcement, and addressing concerns from taxpayers and non-residents.

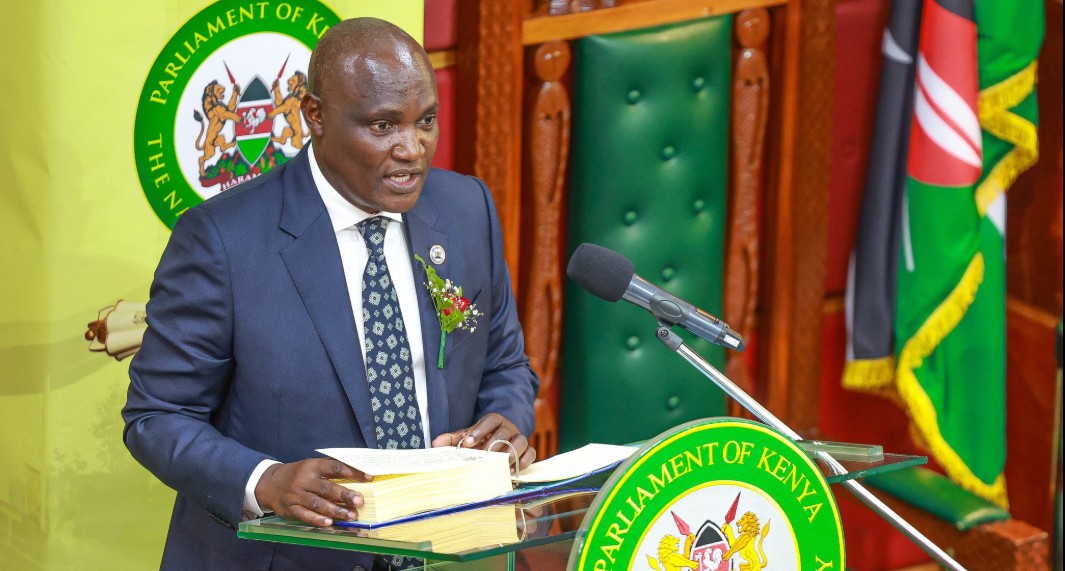

Treasury Cabinet Secretary John Mbadi said the proposed amendments are meant to close loopholes, remove barriers to the recovery of unpaid taxes, and make the tax system more transparent and fair.

More To Read

- Mbadi confirms Treasury deliberately influencing shilling’s value against dollar

- Finance Committee slams CS Mbadi for dodging key oversight sessions

- Treasury slashes revenue targets, signals higher borrowing ahead

- Mbadi urges State agencies to prioritise PPPs in project planning

- Kenya eyes TDB loan to clear Sh51.6 billion debt due September

- Mbadi gives counties 30 days to integrate payrolls with IPPD

“These changes will improve compliance and help us collect revenue on time,” he said while presenting the budget statement for the Financial Year 2025/26.

One of the key proposals is to expand the scope of agency notices to include non-resident persons, allowing the commissioner to recover unpaid taxes from them more effectively.

To ensure faster collection of taxes after legal disputes, the Bill clarifies that once a judgment is made in favour of the Commissioner, enforcement will only be stopped if a court issues a stay order.

Exempt property transfers

Mbadi also proposed to exempt property transfers made by or to the commissioner during tax recovery from stamp duty, removing financial and legal barriers that may slow down the process.

Another amendment will require the commissioner to give reasons when sending amended tax assessments to taxpayers.

The Treasury CS said this will promote transparency and build public trust in the tax system.

To address complaints from taxpayers, the Bill also gives the Cabinet Secretary the power to waive penalties and interest caused by system delays or administrative errors, if recommended by the commissioner.

Top Stories Today